The recent decision[1] by the Pakistani government to reduce truck load capacity by 50% under the Axle Load Regime (ALR) has sparked intense debate, touching upon road safety, economic stability, and the potential role of rail freight as a viable alternative. This measure, aimed at minimizing highway accidents and aligning with international standards, has profound implications for over 45 local industries.

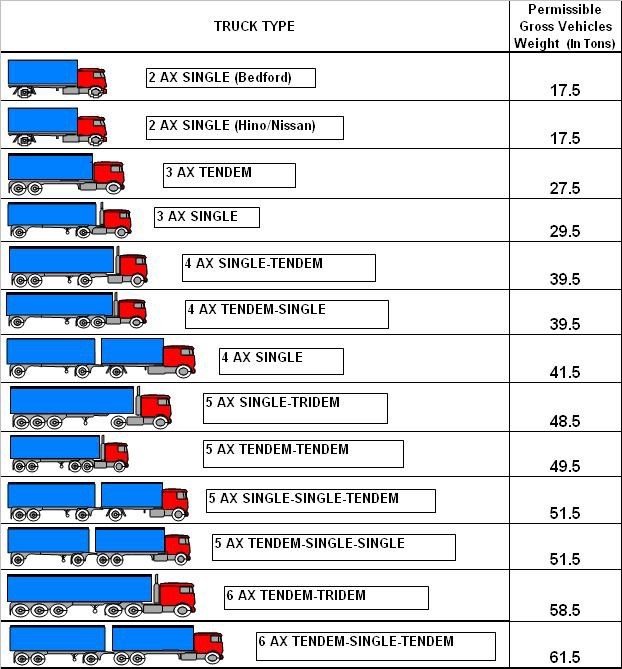

In transportation, “axle load” refers to the amount of weight that is carried by a single axle of a vehicle. This is an important factor in road and vehicle engineering, as roads and bridges are designed with maximum axle load limits to ensure safety and prevent damage. The axle load affects how much wear and tear a vehicle inflicts on the road surface. Understanding this term can add realistic details to stories involving transportation, engineering, or logistics.

The Immediate Economic Impact

The transport industry faces an immediate challenge. With approximately 330,000 trucks currently on the road, the new axle load limitation means Pakistan will require an additional 200,000 trucks to transport heavyweight products. Given the domestic production capacity of only 9,000 to 10,000 units per annum (without import restrictions), it would take 20 to 25 years to meet this demand domestically. The alternative, importing the required trucks, would cost around $12.5-$ 13.0 billion and take 2 to 3 years, leading to a significant economic slowdown.

Wider Industrial Impacts

– Oil Industry: About half of the country’s oil tankers are non-compliant with the new axle load regulation. The shortage of compliant vehicles could lead to a 20-25% fuel shortage, triggering higher prices and potentially black marketing.

– Cement Industry: The cement industry faces a potential drop in sales from 42 million tons to 20 million tons, resulting in a revenue shortfall of approximately Rs 71 billion annually. This will also lead to increased prices due to higher transportation costs.

– Steel Industry: With a predicted rise in transportation costs, the steel industry could see a 20% increase in input costs, leading to higher prices. The total tax revenue shortfall could reach Rs 12 to 15 billion annually.

– Agriculture Sector: A 40-50% reduction in DAP and fertilizer supplies due to transport limitations could lead to a 30-40% decrease in agricultural produce, escalating food shortages and prices.

Employment and Tax Revenue Concerns

The truck shortage could result in massive unemployment, affecting millions in over 45 industries. This would significantly reduce consumer spending and indirectly impact tax collection on consumer products, leading to a revenue shortfall of over a trillion rupees for the government.

Rail Freight as an Alternative

In light of these challenges, the development of Pakistan’s rail freight system emerges as a critical alternative. However, the railway infrastructure requires significant revamping to become a viable option. This development should occur in parallel with the phased implementation of the ALR. It is the need of the hour that the decision makers in Pakistan look into this aspect, have ML-1 developed on priority and ensure that the rail system works efficiently. Consequently, it is now up to private sector as well to come forward and take the initiative to streamline the industries along with railway route.

Learning from India’s Rail Freight System

India’s efficient rail freight system provides a model for Pakistan. With substantial investments in their rail infrastructure, India has managed to create a more effective and integrated transport network. Pakistan could draw valuable lessons from this model to enhance its own rail freight capabilities.

Conclusion

The ALR presents a complex challenge for Pakistan, requiring a balanced approach that considers both safety and economic implications. The exploration of rail freight as an alternative, coupled with phased ALR implementation, offers a pathway towards a more integrated and sustainable transportation system. The decisions made today will significantly influence not only the transportation industry but also the broader economic landscape of Pakistan.