As a starting point, an efficient strategy could be to classify and structure the data. The data can be structured into based on the spend. Traditionally the spend analysis was done by conducting an ABC analysis or simplistically the pareto analysis. Which means 80% of the spend is conducted by 20% of the suppliers and therefore the supply chain strategy revolves around the top 20% suppliers.

In my personal experience while compiling and analysing the data you will find one-off spends. For example, one year there was a one-off order for a certain commodity and that supplier fell into the top 20%. However, the organisation will not be working with this supplier for probably the next 10 years so why push the team to delve into preparing a strategy for a supplier. We can see in figure 1.1 that Gensets is a high value item. We can’t classify it as strategic as this is a Capital expense (CAPEX) which is a one-off expense. We can further classify procurement in Direct and in-direct spend however this would lead the topic into a different direction.

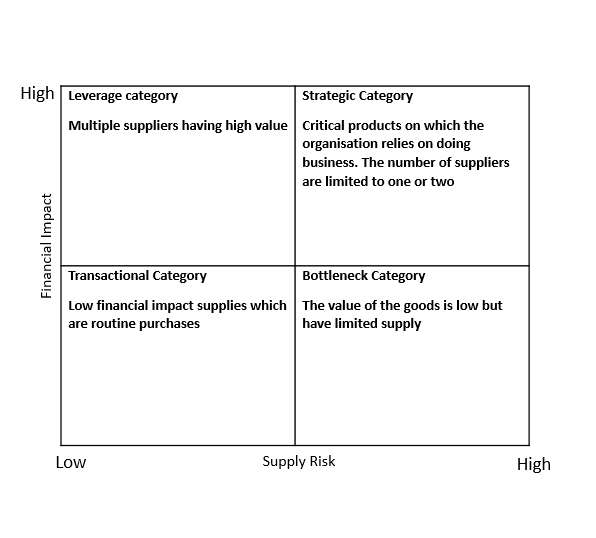

An evolution to spend analysis was presented by Krajlic’s in an HBR article (Krajlic, 1983) . The supply base was divided into categories in a 2X2 matrix called the purchasing portfolio. The supply side risk was represented on the horizontal axis while the financial impact is represented on the vertical axis. Which can be seen in figure 1.2.

Figure 1.2 Krajlics Matrix

The strategic category is where procurement when dealing with these suppliers has a high financial impact, supplier has a high impact on the financial results and the suppliers of these products are limited. To identify these suppliers in the spend of the procurement analyst, practitioners, and executives must evaluate the core dependence of their organisation on the supplier, identify if the suppliers are market leaders. For these suppliers’ procurement teams can establish strategic contracts. Partnership agreement with transparent costing could help establish long term supplier relationships. The merits of such model can be collaborative relationships between buyer and supplier can help them conduct total cost engineering (TCE) to bring down costs. For example, if a machine can use copper instead of silver as a conductor where copper is a much cheaper alternative buyers can achieve significant cost savings. The strategic relationships can help in ensuring that the competitive advantage of the buyer could be sustained whereby the supplier will not go to the competitor. One example of such relationship can be witnessed in dealership agreements with large principals. Flexibility and coordination in agreements could help buyers secure their competitive advantage by restricting suppliers to just work with them. Coordinated strategic relationships can also help in buyers foresee price escalations in advance.

The second category is where the procurement when dealing with the suppliers has a high financial impact. Under such category potential savings can be made through competitive bidding, executing buyer dominated negotiations. The organisation can adopt qualify up to policy for suppliers as the traditional pre-qualification process consumes a lot of time. Man, hours spent in the procurement process must be calculated within the total cost of ownership (TCO). Which is in the simplistic form all costs associated with the acquisition of a product through out its life cycle. At the time of placement of order traditionally the lowest bidder takes the whole order. A proposed approach based on the terms of purchase including credit period offered and prices offered suppliers would compete amongst each other to get a larger share of volume (Chaturvedi, et al, 2014). Another way to look at this model is to evaluate supplier performance through on time and in full metric. Which can measure the compliance level of the supplier based on their delivery time and quantity mentioned on the purchase order. Based on this performance buyers can allocate volume shares to suppliers. This can be ideal in cases where Maintenance Repair and Operating supplies (MRO) or Customer service-related products are needed. The supply chain design is responsive instead of lean. In such cases where price is not a concern service levels can be leveraged. A more holistic approach when establishing a leverage supplier category is to adopt a balanced score card (Kaplan & Norton, 1992). Where a checklist of Service, Quality, Sustainability and Costs could help in making procurement decisions through Multi Criteria Decision making (MCDM) approach. Creating competition amongst suppliers on price and services suppliers would make effort to make their products to be more superior in the eyes of the customer which is the buyer (Christopher, 2016).

The third category is the transactional products those items having the least financial impact and minimal supply risk. Now this can be classified as stationery items, pantry items or services like day-to-day repair operations colloquially building management systems (BMS). As mentioned earlier the procurement of has a human cost. If there are 20 transactions a month with such suppliers, it is not justified to go again and again to the same supplier spend time in negotiating with them repeatedly. Therefore, prices can be negotiated at the start of each year a blanket purchase order could be granted to such suppliers. This approach helps save valuable man hours.

The final category is bottleneck supplies which have limited availability but have a low financial impact. In such cases the suppliers are in a dominant position. Example can include a pigment for the paint industry (Van weele, 2018). The value is very less but the product completion is dependent on such a small item having less availability. Buyers can particularly focus on achieving supply continuity, like making payments on time establishing strong supplier relationships. Not to focus on the cost saving aspect for such products. To reduce dependence on such supplier’s procurement teams must focus on sourcing alternatives or developing capability to insource material.

This is a simplistic classification style as what as a buyer we consider a strategic partner the supplier might consider us as a transactional customer. The balance of power between buyer and supplier can further be worked upon through the Dutch windmill and negotiation planning.

Disclaimer

These ideas are subjective and represents perspective of a buyer and a supply chain researcher evaluating procurement best practices.

References

Kraljic, P. (1983) ‘Purchasing must become supply management’, Harvard Business Review, September-October:109–17.

Chaturvedi, A., Beil, D.R. and Martínez-de-Albéniz, V. (2014) ‘Split-Award Auctions for Supplier Retention’, Management science, 60(7), pp. 1719–1737. doi:10.1287/mnsc.2013.1835.

Kaplan, R. S., and D. P. Norton. 1992. The Balanced Scorecard: Measures that drive performance. Harvard Business Review (January-February): 71-79

Weele, A.J. van (Arjan J.. (2018) Purchasing and supply chain management. Seventh edition. Australia: Cengage: 177