The Harmonized System (HS) code is a standardized numerical method of classifying traded products. It is used by customs authorities around the world to identify products when assessing duties and taxes and for gathering statistics. The HS code system is governed by the World Customs Organization (WCO) and is updated every five years. It is used by more than 200 countries and economies as a basis for their customs tariffs and for the collection of international trade statistics.

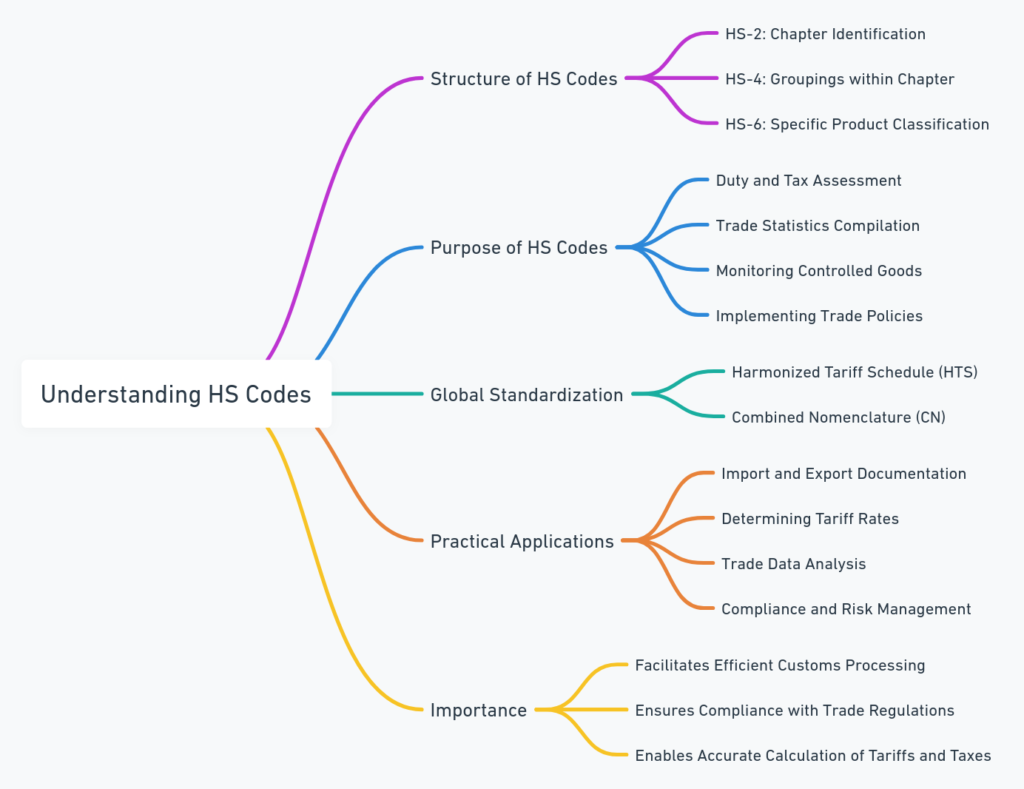

Understanding HS Codes

- Structure of HS Codes:

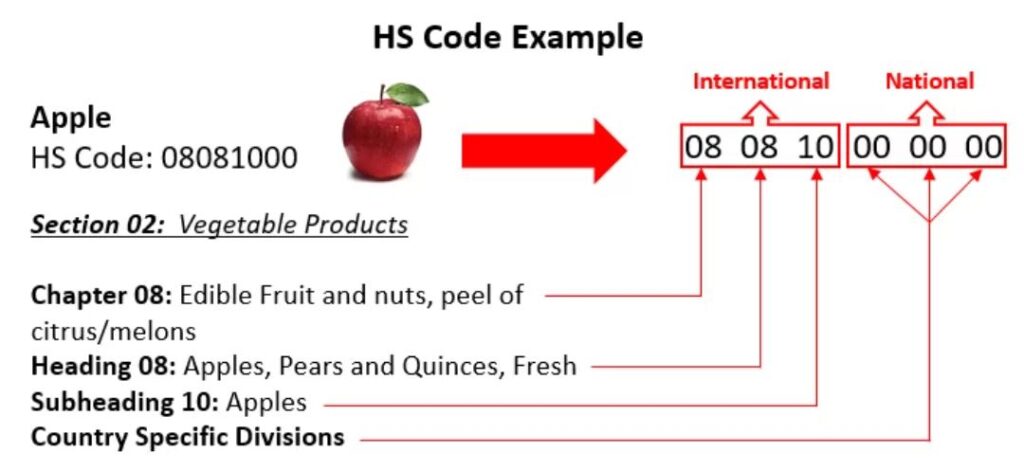

- The HS code is a six-digit number, with each set of digits representing a specific classification. The first two digits (HS-2) identify the chapter the goods are classified in, e.g., 09 for Coffee, Tea, Mate, and Spices. The next two digits (HS-4) identify groupings within that chapter, e.g., 09.02 for Tea. The last two digits (HS-6) are even more specific, e.g., 09.02.10 for Green tea (not fermented).

- Example: An exporter of green tea would use the HS code 09.02.10 to classify their product in international trade documents.

- Purpose of HS Codes:

- HS codes are used by customs authorities to determine the duties and taxes that should be applied to a product. They are also used to compile trade statistics, monitor controlled goods (such as firearms or endangered species), and implement trade policies (such as tariffs or quotas).

- Example: A customs department uses the HS code to quickly determine the import duty applicable to a shipment of laptops.

- Global Standardization:

- The HS code system is internationally standardized, but countries can add additional digits to classify products more specifically according to their own needs. These extended codes are known as the Harmonized Tariff Schedule (HTS) in the United States and the Combined Nomenclature (CN) in the European Union.

- Example: The United States might use a 10-digit code where the first six digits are the HS code, and the additional four digits provide further classification.

Practical Applications of HS Codes

- Import and Export Documentation:

- HS codes must be included in import and export documentation, such as commercial invoices and shipping documents. This ensures that the products are properly classified and taxed by customs authorities.

- Example: An exporter of machinery parts to Germany includes the HS code on the commercial invoice to ensure correct duty assessment by German customs.

- Determining Tariff Rates:

- Importers and exporters use HS codes to determine the tariff rates that will be applied to their products. This is crucial for pricing products and understanding the cost implications of cross-border trade.

- Example: An importer of olive oil into Canada refers to the HS code to determine the applicable duty rate under the Canada-European Union Comprehensive Economic and Trade Agreement (CETA).

- Trade Data Analysis:

- Governments and businesses use HS codes to analyze trade data. This data can be used for economic research, market analysis, and policy-making.

- Example: A government agency analyzes trade data using HS codes to identify trends in the import of renewable energy equipment.

- Compliance and Risk Management:

- Correct classification of goods using HS codes is essential for compliance with customs regulations. Misclassification can lead to penalties, delays, and increased scrutiny from customs authorities.

- Example: A multinational corporation conducts regular audits of its HS code classifications to ensure compliance and manage the risk of customs penalties.

Importance of HS Codes

HS codes are essential for international trade, providing a common language for classifying goods. Accurate use of HS codes facilitates efficient customs processing, ensures compliance with trade regulations, and enables the accurate calculation of tariffs and taxes. For businesses engaged in international trade, understanding and correctly using HS codes is crucial for smooth operations and compliance.

In conclusion, the Harmonized System code is a vital tool in global trade, used for classifying goods in a systematic and standardized manner. It aids in customs processing, trade policy implementation, and economic analysis. Businesses engaged in international trade must ensure accurate classification of their products to avoid customs issues and to understand the financial implications of their trade activities.